Commercial aerospace EBIT returned to positive territory in 2021 after a rare negative performance in 2020, with the rebound led by strong performances by lessors, engine OEMs, and equipment OEMs. Revenue performance was flat, and margins remain modest when judged against historical levels. The sector presents a mixed bag when it comes to profits. Aircraft OEMs only returned to breakeven as a strong Airbus and Boeing, which is still in recovery mode, turned in dramatically different results. The performance of the supply base varied by segment, with some segments still in the red.

Recovery Underway, but Weak Spots Remain

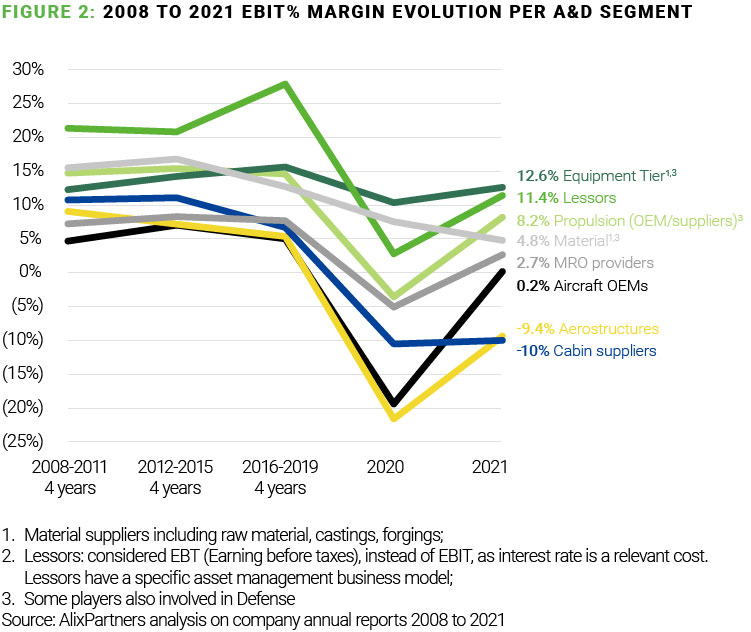

COVID-19 dealt the commercial aerospace profit pool a tough hand as the sector saw a $51 billion EBIT decline in 2020, representing an unprecedented reversal. Margins fell from 9.9% (2019) to -7.8% (2020), bouncing back to 4% last year. Lessors generated 11.4% EBIT (vs. 2.8% in 2020), representing half the profit pool. This is not at historical levels but represents resilience. Engine OEMs posted 8% EBIT, making a key contribution to the profit pool as some were able to return to pre-pandemic profitability levels. Equipment OEMs are the most profitable (13% EBIT).

Meanwhile, aerostructure and cabin suppliers continue the struggles they experienced prior to the pandemic as they dealt with operational issues and restructuring.

Aircraft OEMS Lose Profit Pool Footing; Lessors, Engine/Equipment Suppliers Surge

The story of aircraft OEMs remains a bifurcated tale, with Airbus significantly outperforming Boeing over the past five years. Historically Boeing has been more profitable than Airbus, but Airbus’ strong performance and the 737 MAX crisis turned the tables allowing the European OEM to take the lead. The gap increased with the more recent issues on the 787.

Lessors have picked up some of the aircraft OEM’s slack and are now a major component of the entire commercial aerospace profit pool. They are expected to expand operating profit through revenue growth, with varying performances on margin. The steady recovery of air traffic, combined with the revised delivery outlook for aircraft OEMs constrained by supply issues and labor shortages, will work in favor of lessors – particularly those with narrowbody aircraft in their portfolios.

But lessors are also facing some headwinds from the Ukraine crisis that will likely result in billions of dollars of impairments and multiyear litigation with insurers.

Engine suppliers weathered the downturn reasonably well, with EBIT margins dipping slightly into the red in 2020 (-3%) and recovering substantially in 2021. Select players, including Safran and MTU, returned to pre-crises margin levels in 2021. Their resilient performance was driven in part by early and significant efforts to control costs during the pandemic. It may be a challenge for engine OEMs to continue to drive healthy margins given recent challenges with delivery caused by labor and material issues in their supply chains.

Aerostructure and cabin suppliers were experiencing margin declines pre-pandemic, and the downturn hit them particularly hard. Both segments generated significant losses in 2020 and realized only modest rebounds in 2021, still generating -9% to -10% EBIT margins. Cabin suppliers’ reliance on the widebody market has also been a headwind that has muted their performance.

Investors Expect Varying Levels of Performance Improvement

As mentioned, the two major OEMs are on separate trajectories in terms of profitability. Still, investors are expecting Boeing to make up ground with significant short-term revenue growth as it restarts deliveries that have been paused. Boeing may have finally turned a corner as 787 deliveries restarted in August, and analysts expect operating margins to snap back with volume growth. Meanwhile, analysts forecast Airbus to post moderate revenue growth, tempered by capacity constraints and supply chain challenges, with topline expected to reach 2019 peaks by 2024 and margins expanding 100-200 bps over the next two years.

Aerostructure suppliers are expected to realize the largest margin improvement over the next two years, with some key players forecasted to realize 1,500 bps+ of margin improvement from 2021-2023. While their rebound has been delayed, material margin improvement is expected in the segment by 2023.

In segments that were more resilient through the pandemic and bounced back in 2021, analysts expect more modest and steady margin improvement going forward. Engine OEMs are expected to realize between 400 to 500 bps of margin improvement over the next two years, and equipment OEMs are expected to realize 200-300 bps of margin improvement. Realizing this forecasted level of improvement would bring both segments back to near pre-pandemic margin levels by 2023.

To realize superior value growth and shareholder returns going forward, companies must exceed these forward-looking expectations. Meeting and exceeding expectations won’t be easy as the commercial aerospace industry is likely to continue to face challenges going forward.

Disruptions Persist even after COVID storm

While the COVID crisis is now mainly in the rearview mirror, the industry is facing significant headwinds that are putting pressure on the margins as economic and market turmoil continue to disrupt in the following ways:

- Supply chain: Lead times have ballooned while visibility into availability and volumes has diminished. Shortages are spread across multiple categories, starting with engines. Other critical segments include electronic components, plastics, forgings/castings, and cabin.

- Inflation: Escalating costs for materials, energy, transportation, and labor affect manufacturing, supply chain, and the customer base. Interest rate hikes and currency fluctuations complicate financial planning ahead of a potential recession.

- Labor shortage: The limited workforce availability is putting additional pressure on wages and creating labor productivity challenges as new employees develop their skills after a period of big layoffs. Hiring and retaining talent is a major challenge.

- Ukraine crisis: Russia’s action in Ukraine has potential consequences for titanium supply. In addition, aircraft deliveries to Russian customers are suspended following international sanctions. Finally, leasing contracts have been terminated with Russian operators, affecting airworthiness, denting aircraft values, and triggering litigation.

- Sustainability: The path toward net-zero emissions requires all levers being pulled, putting additional strain on investments for the value chain and the challenge of navigating technological uncertainties.

In this context, the path to achieving top quartile shareholder returns must combine the management of the challenges described above with a strong focus on improving program margins. While price increase is sometimes an opportunity, the key driver to expanding margins in aerospace is the reduction of program unit costs. In our experience, a successful unit cost reduction program is based on five critical pillars:

- Clear understanding of the cost structure, with a unit cost baseline and outlook at program/system/sub-system level. A clear and detailed visibility is critical to prioritize the cost reduction effort and identify the critical areas to be tackled. How will the cost of your product evolve over the next five years? What is your exposure to inflation and do you have a well-integrated plan to reduce its impact on your margins?

- Multi-Functional Team (MFT) approach to identify and assess cost reduction opportunities, bringing the know-how of various functions. Program role is critical to driving and accelerating the idea generation and execution, challenging and driving all key functions.

- Ambitious but realistic targets per program cascaded to each MFT. It is critical to set the same target across functions to create a common goal and unlock the most advanced cost reduction levers, such as redesign-to-cost and value chain improvement. Incentives at all levels must be tied to the shared target.

- Iterative process based on pipeline management will underpin a “gap to target” approach. This is an iterative process of idea generation and pipeline management until the target is reached. The starting point is the assessment of the in-flight initiatives and their impact on the unit cost.

- Strong governance to drive execution, based on a strong first-hand involvement of top management. Visibility, time commitment, role modeling: ‘walk the talk.’’

Look for opportunities

While the commercial aerospace profit pool has bounced back from 2020’s historically low levels, 2021 profitability was still well below pre-pandemic levels. Investors expect margins to continue to improve toward pre-pandemic levels. Meeting and exceeding these expectations will require a dedicated focus on margin expansion in the face of persistent disruptions.

Importantly, the continued disruptions will likely also provide opportunities, particularly for stronger players who will have the opportunity to take share from struggling competitors and pursue opportunistic M&A.

For a deeper discussion on this topic, contact:

Eric Bernardini

Managing Director

ebernardini@alixpartners.com

Alain Guillot

Managing Director

aguillot@alixpartners.com

About our Analysis

The analysis in this article is based on a sample of publicly available data for each segment. Any forward-looking expectations are based on an aggregation of analyst consensus estimates and AlixPartners analysis.

/Passle/5e1358328313d50770039d23/MediaLibrary/Images/6093fd71e5416b04ac4aebca/2024-01-09-14-29-41-938-659d5855146256acfd0a0c9b.jpg)

/Passle/5e1358328313d50770039d23/SearchServiceImages/2024-04-23-16-40-41-093-6627e489160531884bcdb1ef.jpg)

/Passle/5e1358328313d50770039d23/SearchServiceImages/2024-04-23-06-03-34-017-66274f36e87bcfeefc95b010.jpg)

/Passle/5e1358328313d50770039d23/SearchServiceImages/2024-04-23-02-33-05-150-66271de1d100dba38ac14189.jpg)