Technology companies have amassed considerable value in recent years driven primarily by a story of top-line growth with limited regard for profitability. In the past two years alone, fueled by pandemic disruption, this sector grew exponentially, leading to record valuations and investment activity. Growing market share and revenue at any cost has proven to be a winning strategy.

However, as pandemic-fueled growth has begun to wane, closer analysis tells a different story. In the past six months, as COVID-driven growth has subsided, valuations have shifted, and both tech executives and investors have discovered a newfound sense of urgency.

Where do we go from here?

While economic factors such as inflation, slowing growth, and a tougher financing environment challenge top-line growth and are largely outside of a company’s control, returning to business fundamentals and challenging the so-called Rule of 40 – the notion that a company’s combined growth rate and profit margin should be greater than 40% – are all within management’s power.

And increasingly, investors, including private equity, are also favoring a stronger balance of growth and bottom-line profitability when making investment and valuation decisions. Their focus on fundamental business operations has become more acute, and as a result, technology executives will need to reassess their operating and financial strategies.

Investors must return to fundamentals

In our recent analysis of 3,500 technology companies, we found that total enterprise value-to-revenue multiples (a measure often used in valuations) grew at an average rate of 6% per quarter from Q1 2020 to Q2 2021. However, from Q2 2021 to Q1 2022, that multiple contracted by an average rate of 5% per quarter (figure 1).

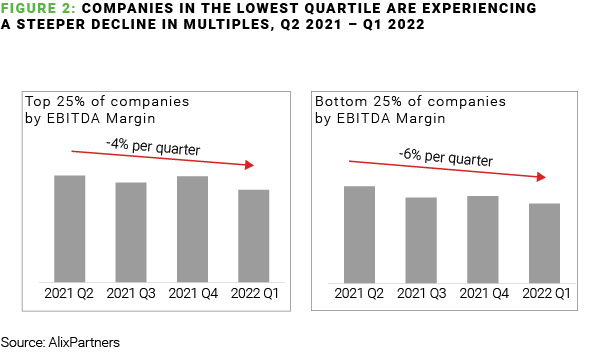

More importantly, when looking at EBITDA margins, tech companies in the bottom 25% showed a steeper decline in multiples by almost 30% compared to tech companies performing in the top cohort (figure 2). Again, indicating a shift as investors turn their focus from pure growth toward a balance of growth and profitability.

COVID-era growth, driven by companies racing to modernize and transform their IT systems and infrastructure to accommodate changes brought forth by the pandemic, is starting to subside. This has revealed limitations in the projected future growth rates of many companies that benefited from COVID-driven disruptions.

In recent earnings announcements, over 35 US technology companies lowered revenue guidance (figure 3) —a trend we expect to continue throughout the remainder of this year, driven both by the macro environment and an increasing focus on both growth and profitability.

Whether this trend indicates a secular move toward business fundamentals or a temporary shift, one thing is certain: The Rule of 40 can no longer be achieved by growth alone.

Profitability as a source for growth

As businesses seek stronger valuations, the question is where to focus effort and investments.

Company executives often see growth and profitability as competing objectives. For example, in 2021, Gitlab’s focus was centered on converting free users to paying members to improve the top line. And they did – growing 87% year over year. But the substantial investment to execute deteriorated the bottom line, leading to a decline in earnings by $88 million.

It doesn’t have to be a stark case of growth vs. profitability. In fact, optimizing processes and streamlining operations can often deliver better margins across the organization, promoting top-level growth. Freeing up cash flow to invest towards growth will be a critical priority for tech firms in the months ahead, especially as interest rates rise and the financing environment becomes more challenging.

Accomplishing this feat requires substantial rigor and expertise, as well as buy-in across the organization. To this end, we recently helped a fast-growing tech company improve profitability in their commercial business to prepare for a successful IPO. Through a comprehensive operational transformation, we helped to improve optimization, remove impediments, reduce internal friction, and improve productivity. Our client’s EBITDA almost doubled (from 9 to 17%) and further accelerated revenue growth.

The future: the scale tips toward profitability (back to basics …)

In an economic landscape pressed with new challenges, investors are making one thing clear: top-line growth will no longer suffice. Whether or not this trend represents a secular move toward business fundamentals or a temporary shift, it’s clear that tech companies must be more aggressive toward optimizing operations, controlling costs, and improving profitability to drive the right balance. Those that do will secure more resilient and sustainable business models that will be positioned for success well into 2022 and beyond.

/Passle/5e1358328313d50770039d23/MediaLibrary/Images/6093fd71e5416b04ac4aebca/2024-01-09-14-29-41-938-659d5855146256acfd0a0c9b.jpg)

/Passle/5e1358328313d50770039d23/SearchServiceImages/2024-04-18-13-21-01-803-66211e3d7330266071d541da.jpg)

/Passle/5e1358328313d50770039d23/SearchServiceImages/2024-04-16-18-48-31-181-661ec7ff631126c32d270bbb.jpg)

/Passle/5e1358328313d50770039d23/SearchServiceImages/2024-04-16-07-49-16-790-661e2d7c4025ff662f6862d1.jpg)