Retail and fashion experienced some of the sharpest shifts in consumer behaviour, with lockdowns effectively stranding the high street, drastically raising the stakes for incumbent players to ramp up their digital offerings to survive, let alone remain relevant to consumers who had pivoted at pace to online for their purchases.

Recent research and analysis that we’ve undertaken suggests that fashion retailers who have now established a strong omnichannel offering will be in pole position to benefit initially post-pandemic. Our data has revealed that omnichannel is now the most common shopping preference in UK fashion, accounting for 73% of shoppers and 80% of overall market spend. Average total spend per omni-shopping consumer per year is also 84% higher than those who shop in stores only and 32% more than online-only shoppers.

Is online dominance still the future end-state?

Approaching the two-year anniversary of the first lockdown in the UK, the question needs to be asked as to whether this dominance of omni-shopping will persist for the long term. Will this be the “new normal” as the loosening of restrictions boosts store visits? Or is it just an intermediate phase towards final online dominance in the future?

The position of different fashion retailers towards these scenarios varies significantly. Some online natives have consolidated their market position effectively by making front-end investments in well-known consumer brands, and as a result they have strong growth potential in either scenario. Their digital capabilities allow them to scale at speed, setting up new marketplaces targeted at different micro-segments, while also eating into the customer base of traditional retailers and/or other international audiences. The online market may be increasingly fragmented, but there is still room to grow for those who act fast, subject to capital intensity and ROI: body shapes and sizes, diverse life-stages, niche lifestyles, diverse fabrics etc.

Traditional retailers, however, will find themselves in a more difficult position. Those who have survived the pandemic are in no position to breathe a sigh of relief yet. They’ll unlikely be at the peak of the digital learning curve and must forge on to complete their omni transformation, right-size their store network and redefine its role – all whilst sustaining their brand and market position as business as usual. This is a challenge if omnichannel dominance is indeed the new normal and further change proves to be incremental going forward, but becomes a tall order if online dominance is the future end-state and further deep disruption is on the cards.

Our data suggests that a greater skew towards online may still represent the long-term direction of travel. As Figure 1 shows below, the omni consumers who shop more with online-native retailers spend more online and up to two times more overall, versus those shopping with traditional retailers.

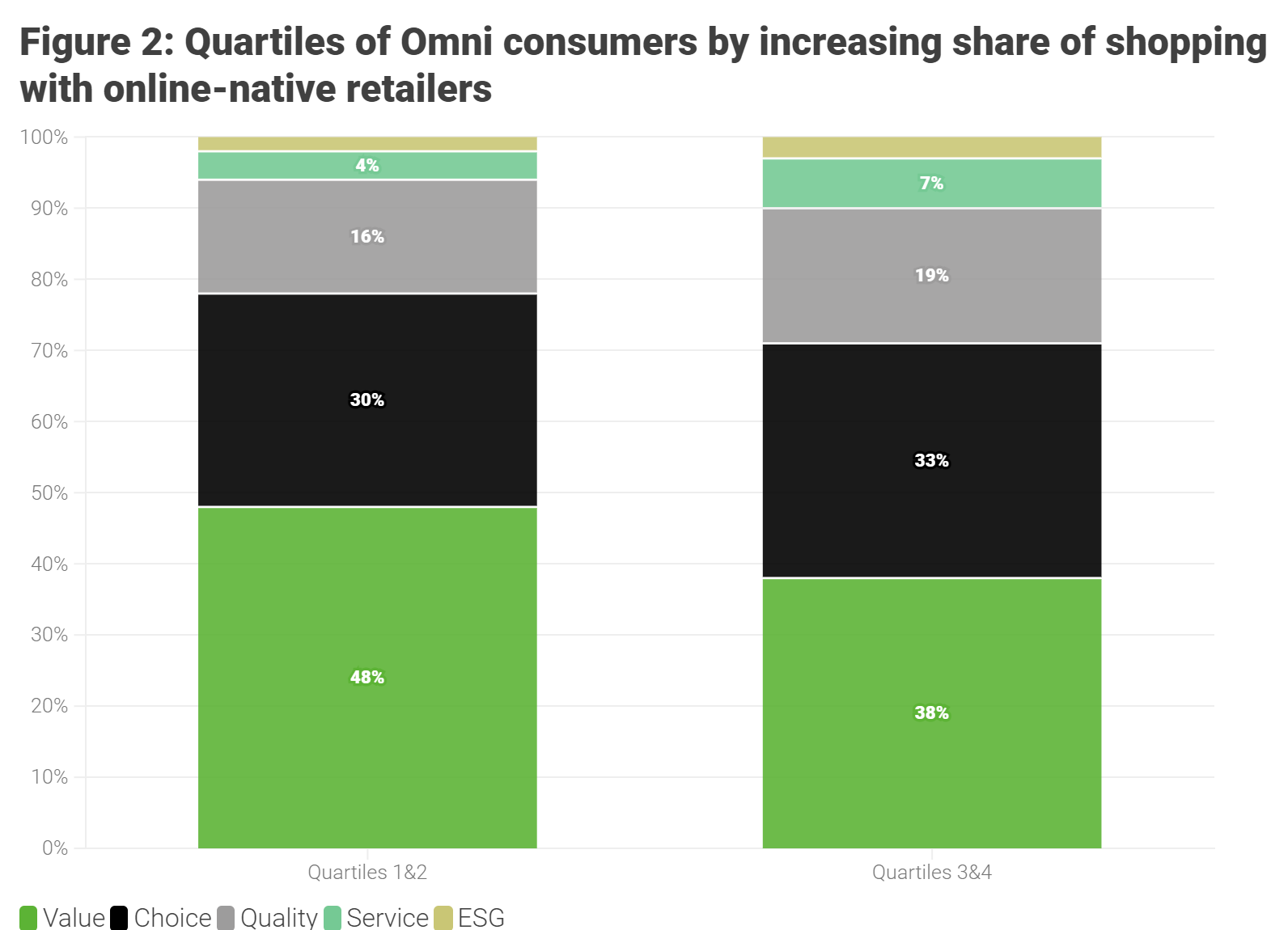

Furthermore, Figure 2 demonstrates that important value dynamics are under way below the surface. For omni-shoppers leaning towards traditional retailers, value is by far the most important factor outweighing choice and quality. However, for those whose spend is skewed towards online-native retailers, the importance of choice and quality trumps value – the hallmarks of a better ‘profit zone’.

An existential digital-first conundrum is yet to be solved

We wrote in the early stages of the pandemic about the challenges faced by “muddle in the middle” brands in retail. It seems now that the clock is well and truly ticking down before an even more pronounced shift to online causes severe profit erosion and potentially further failures among traditional retailers.

There remains an existential conundrum for these brands to solve. Accepting that the customer is king and will ultimately dictate what must be done to capture sales, simply getting fit for an omni scenario via a digitally-supported business model is unlikely to be sufficient. Efforts must be raised on two fronts:

- Internally, by stretching the transformation ambition and agenda all the way to a digital-first model: not just technology but also from operating model and organisational re-design perspective. There are also strong potential B2B upsides beyond boosting B2C sales. Proven, dynamic, white labelled online sales platforms will be in high demand from other players in the future.

- Externally, by establishing a more distinctive value proposition: The first priority is to establish and ensure effective communication of a clear brand position, be that around value, choice, quality etc. Then, this offer can be tuned to target different consumer groups via a portfolio of sub-brands to increase coverage of and relevance to an increasingly segmented market. As the market continues to mature, the pace of fragmentation and segmentation will only increase, as we have seen in other industries such as motor insurance, where hyper-targeted product offerings are developed for very distinct customer demographics.

Reported business results for last year may suggest that a number of traditional retailers have successfully weathered the tsunami of disruption encountered in 2020 and 2021. However, leadership teams must quickly forget the picture in the rear-view mirror and focus on the road ahead. Otherwise, they may miss the underlying turning of the apparel tide.

/Passle/5e1358328313d50770039d23/MediaLibrary/Images/6093fd71e5416b04ac4aebca/2024-01-09-14-29-41-938-659d5855146256acfd0a0c9b.jpg)

/Passle/5e1358328313d50770039d23/SearchServiceImages/2024-04-23-16-40-41-093-6627e489160531884bcdb1ef.jpg)

/Passle/5e1358328313d50770039d23/SearchServiceImages/2024-04-23-06-03-34-017-66274f36e87bcfeefc95b010.jpg)

/Passle/5e1358328313d50770039d23/SearchServiceImages/2024-04-23-02-33-05-150-66271de1d100dba38ac14189.jpg)