Ozeki (2019) showed that accounting fraud has a negative impact on the stock price.[1] Of interest also is that the magnitude of the fraud often depends on who commits it and how the investigation was conducted.

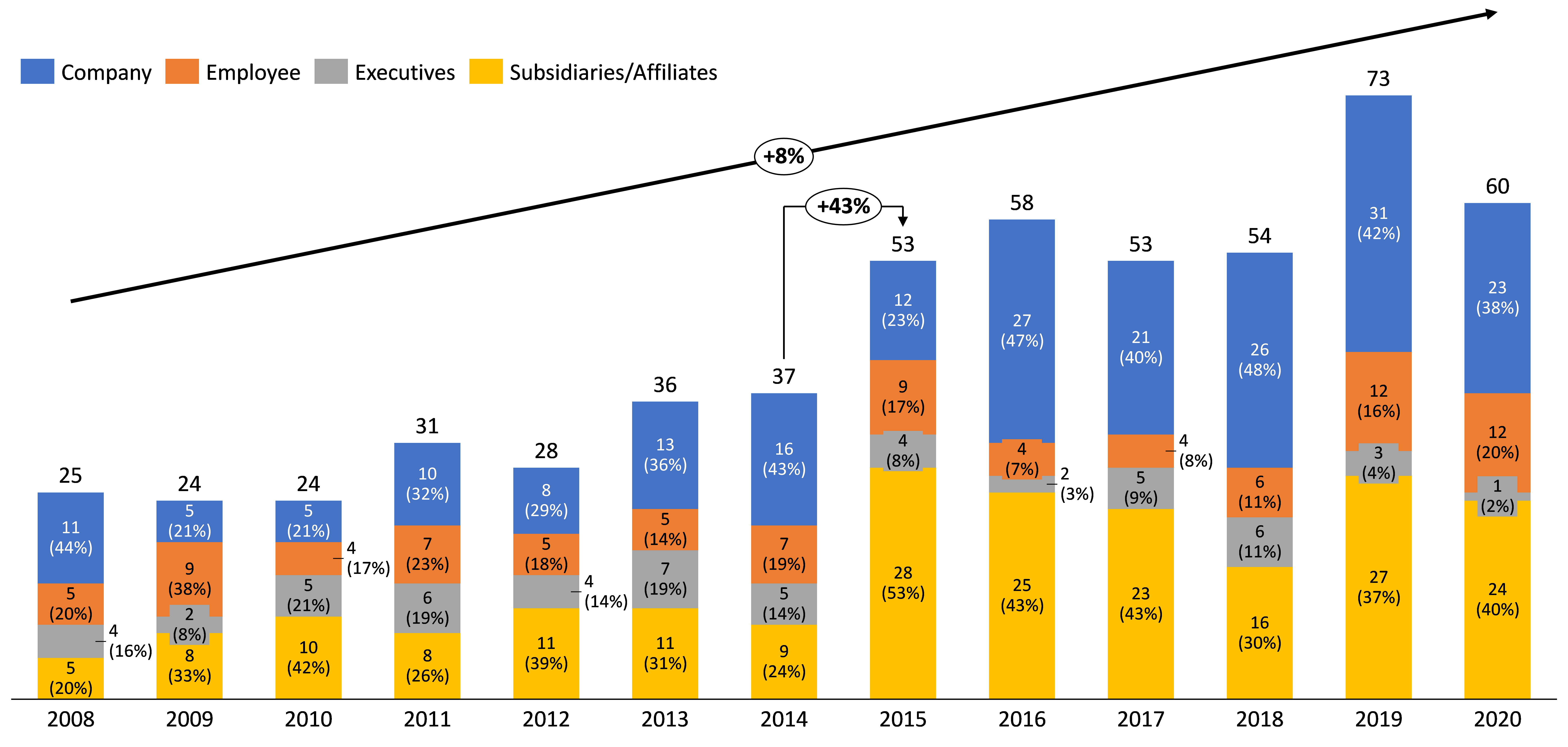

In recent years, the number of financial leakage and misreporting cases disclosed by public companies in Japan has increased from less than 40 cases before 2015 to consistently above 50 cases, and in 2019, 73 cases were reported. Last year alone, a total of 60 inappropriate accounting cases were reported by 58 companies. Of these cases:

- 24 were fraudulent financial reporting and made up 40% of the cases

- 12 were asset misappropriation which accounted for 20% of the cases and

- The remaining were accounting errors

Collectively, over 80% of these cases were committed by the Company (reporting body) or subsidiaries.[2]

Source: Tokyo Shoko Research (https://www.tsr-net.co.jp/news/analysis/20210119_01.html). Chart was prepared by Takahiro Yamada.

According to Ozeki (2019), the impact on the stock price after disclosure is dependent on a few things:

- Type of accounting fraud

- Fraudulent financial reporting such as fictitious revenue and concealed liabilities and expenses:

- This usually has a greater impact as the past financial profits and the future forecasts will be lowered due to the correction of the inflated profit.

- Asset misappropriation:

- This is a concealment of the past loss of assets that have occurred before the misconduct was revealed.

- This normally has a smaller impact due to its limited influence on future profitability.

- Fraudulent financial reporting such as fictitious revenue and concealed liabilities and expenses:

- Who committed the fraud

- Management of the headquarters (i.e. disclosing entity):

- Comparatively, this has a greater impact since it implies group-wide control environment issues.

- Others (e.g., subsidiaries, employees):

- These typically have a smaller impact as control issues are likely to be limited (for example subsidiary level, department level).

- Management of the headquarters (i.e. disclosing entity):

- How the investigation was conducted (transparency of the investigation)

- The investigation led by a third-party independent committee:

- Smaller impact since an investigation led by independent and specialized parties helps to limit the loss of investors’ trust as the investigation is more transparent than an investigation only conducted with internal resources.

- Internal investigation without a third-party independent committee:

- Greater impact due to less transparency and potential conflicts of interest, reducing credibility among investors.

- The investigation led by a third-party independent committee:

To mitigate associated risks, it is firstly important for companies to:

- Periodically re-assess the risk environment and identify their specific risk exposures. Especially under an extraordinary environment such as a pandemic, risk assessments should be conducted more frequently;

- Design a control environment that strengthens controls in high-risk areas, both specific to the company in question, and including the areas identified based on the study by Ozeki (2019) (i.e., headquarters/executive levels, fraudulent financial reporting); and

- Conduct investigations promptly with independent experts to efficiently identify the root causes and remediate the existing issues with stronger controls and transparent processes when potential accounting fraud is alleged or suspected.

If implemented effectively, and in conjunction with an effective external communication strategy, these measures should help reduce the potential adverse impact on the company’s credibility with investors and the decline of its stock price.

References