Andrew Bergbaum

London

Over the last couple of weeks, COP26 has dominated our news feeds, from celebrities taking the podium to leaders catching electric buses to the conference. With the event now coming to a close, EVs and their associated infrastructure remain a central thread in various governments’ ambitious targets for their nations’ transitions to net zero. However, are the appropriate measures and incentives in place to secure that future?

From a UK perspective, early October’s petrol crisis may have convinced many motorists to finally take the plunge and go electric. The significant dent in ease of access to something we all take for granted could prove to be an additional catalyst for electric conversion.

However, charging infrastructure remains a significant worry for motorists, demonstrated by the responses to our 2021 global electric vehicle survey. Two years on from our last survey, the concern around there being enough places to charge a battery electric vehicle (BEV) remains relatively unresolved in the UK (43% in 2021 vs 45% in 2019), while in Germany the issue is more pronounced – it is the top concern for owning or a leasing a BEV, cited by 45% of respondents this year versus 37% in 2019.

Despite these worries, there is an increased appetite to buy a BEV across all of the nations surveyed, which points to a serious charging supply and demand issue on the horizon. In the UK, 36% of respondents say they are very likely to buy or lease a BEV before 2030, up from 22% in 2019 and consistent with the global average of 33% vs 21% in 2019. Even before the petrol crisis had fully unfolded in early October, UK BEV sales had hit 15% of all new vehicle sales in September, up from 11% the previous month.

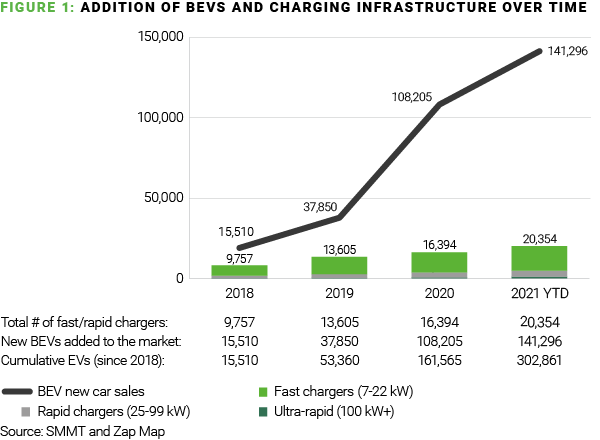

Figure 1 below demonstrates how the number of new BEVs added to the UK market has been exponentially outstripping growth of the fast, rapid and ultra-rapid charger infrastructure. While charger numbers have doubled since 2018, BEVs on the roads have increased by more than 18x – from 15,510 to 302,861.

The ‘available charger to BEV’ ratio mismatch is further compounded by stories of unreliability within the existing charging network. Incompatibility of connectors between marques and charging payment structures that differ between geographical regions amount to a confusing and frustrating puzzle for motorists to solve. Consumer concern, it would appear, is quite legitimate.

If rock-solid trust in the system is to be built among early adopters and then proliferated to those still sitting on the electric fence, manufacturers must commit to ensuring wide availability of charging networks around the world. Only then might we see some acceleration beyond the current status quo where third party and government efforts are falling behind a building groundswell of BEV adoption to meet the UK’s 2035 target.